5 Simple Techniques For Paul B Insurance

Wiki Article

Getting My Paul B Insurance To Work

If there is medical care you expect to require in the future that you haven't required in the past (e. g., you're expecting your very first youngster), you may be able to obtain a suggestion of the possible costs by consulting your existing insurer's cost estimator. Insurance providers usually create these kind of devices to aid their members buy treatment.

Equipped with information about existing and future clinical needs, you'll be much better able to evaluate your strategy alternatives by using your approximated expenses to the plans you are taking into consideration. All the medical insurance prepares discussed over consist of a network of physicians as well as hospitals, but the dimension and range of those networks can differ, even for plans of the very same type.

That's due to the fact that the health and wellness insurance coverage business has an agreement for reduced rates with those specific carriers. As talked about previously, some plans will allow you to make use of out-of-network service providers, however it will certainly cost you a lot more out of your very own pocket. Various other strategies will certainly not cover any kind of care received beyond the network.

Maybe an integral part of your decision. Below's a summary of the ideas offered above: See if you're eligible for an aid, so you can identify what your premiums will be and also so you'll understand where you require to shop. Testimonial your current plan to comprehend how it does or does not fulfill your demands, as well as maintain this in mind as you assess your alternatives.

The 6-Minute Rule for Paul B Insurance

Get cases and also treatment expense data from your existing insurance company's participant site to recognize past as well as prospective future clinical expenses. Utilize this details to estimate out-of-pocket prices for the other plans you're taking into consideration. Study the networks for the strategies you are taking into consideration to see if your recommended medical professionals and healthcare facilities are consisted of.

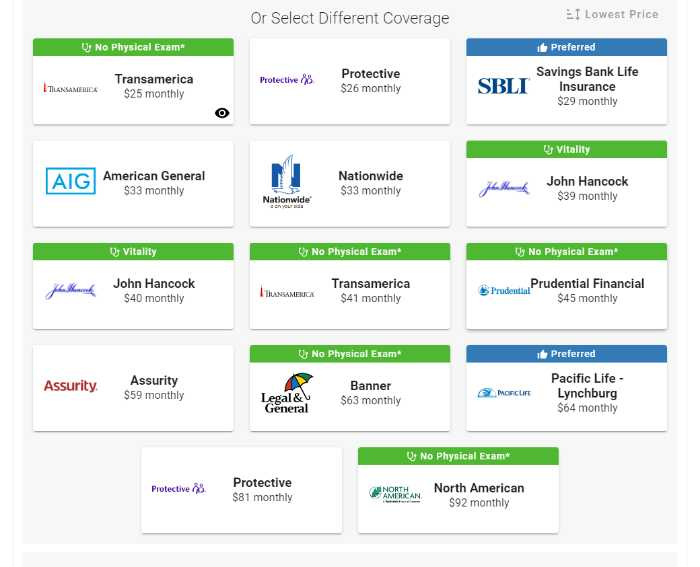

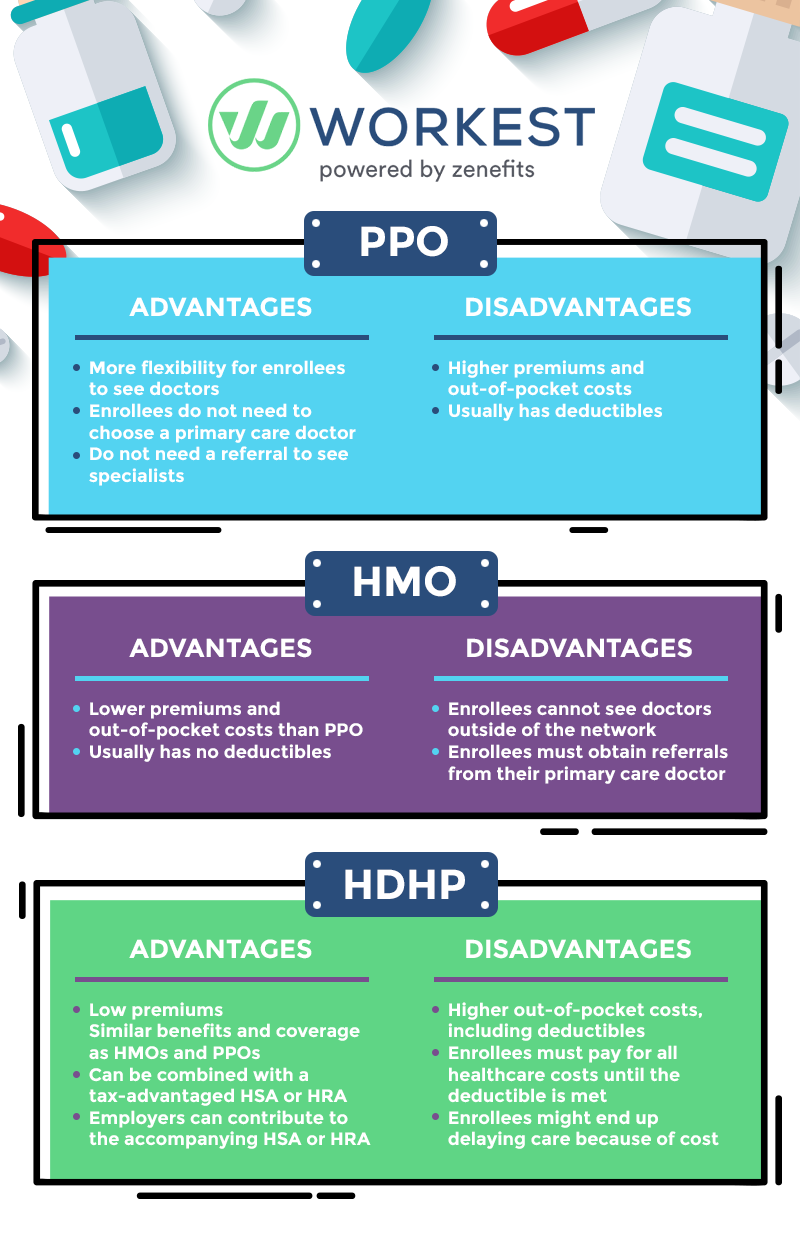

An FFS alternative that enables you to see clinical suppliers that minimize their costs to the plan; you pay less cash out-of-pocket when you make use of a PPO provider. When you visit a PPO you generally will not have to submit cases or documents. Going to a PPO hospital does not guarantee PPO advantages for all solutions received within that medical facility.

Normally enlisting in a FFS plan does not ensure that a PPO will be readily available in your location. PPOs have a more powerful visibility in some regions than others, and in areas where there are regional PPOs, the non-PPO advantage is the conventional benefit.

Your PCP provides your basic healthcare. In several HMOs, you need to get permission or a "recommendation" from your PCP to see other service providers. The reference is a referral by your medical professional for you to be examined and/or dealt with by a different doctor or clinical professional. The referral makes certain that you see the ideal provider for the care most suitable to your condition.

Paul B Insurance Things To Know Before You Get This

You normally pay higher deductibles and also coinsurances than you pay with a strategy supplier. You will also need to submit an insurance claim for repayment, like in a FFS strategy.

A Health and wellness Interest-bearing accounts allows people to pay for existing health and wellness expenditures and conserve for future professional clinical expenses on a pretax basis. Funds deposited into an HSA are not taxed, the balance in the HSA grows tax-free, which quantity is readily available on a tax-free basis to pay medical prices.

HSAs undergo a number of regulations as well as limitations established by the Division visit of Treasury. Browse through Department of Treasury Source Facility to learn more.

Your PCP is your home for care and also guidance. They learn more about you and also your wellness requirements and can assist collaborate all your treatment. If you need to see a specialist, you are required to obtain a recommendation. Nonetheless, like a PPO, you can likewise choose to see specialists that are in-network or out-of-network.

websitesWhat Does Paul B Insurance Mean?

If you currently have health and wellness insurance coverage from Friday Health Plans, your insurance coverage will pop over here certainly end on August 31, 2023. To remain covered for the remainder of 2023, you should enroll in a brand-new plan. Get going

With a PPO strategy, you can save money if you use doctors in the strategy's network. You can also utilize physicians, medical facilities, and also carriers beyond the network but it will cost even more. A PPO plan might be best for you if: You favor a lot more liberty in your choice of doctors as well as medical facilities You intend to see experts without a recommendation You have a physician you currently such as and also do incline paying more in overall prices for a broader network of carriers An EPO is a hybrid of an HMO and a PPO.

Workers have an annual insurance deductible they have to satisfy prior to the health insurance company starts covering their clinical bills. They might additionally have a copayment for certain services or a co-insurance where they are in charge of a percent of the complete fees. Services beyond the network usually cause higher out-of-pocket costs.

Report this wiki page